Demystifying the Probate Process: A Step-by-Step Guide

Feeling overwhelmed by the probate process? You’re not alone. While it may seem complex, probate is simply the court-supervised procedure for settling a person’s estate. This involves validating their will, paying off debts, and distributing property to the rightful beneficiaries.

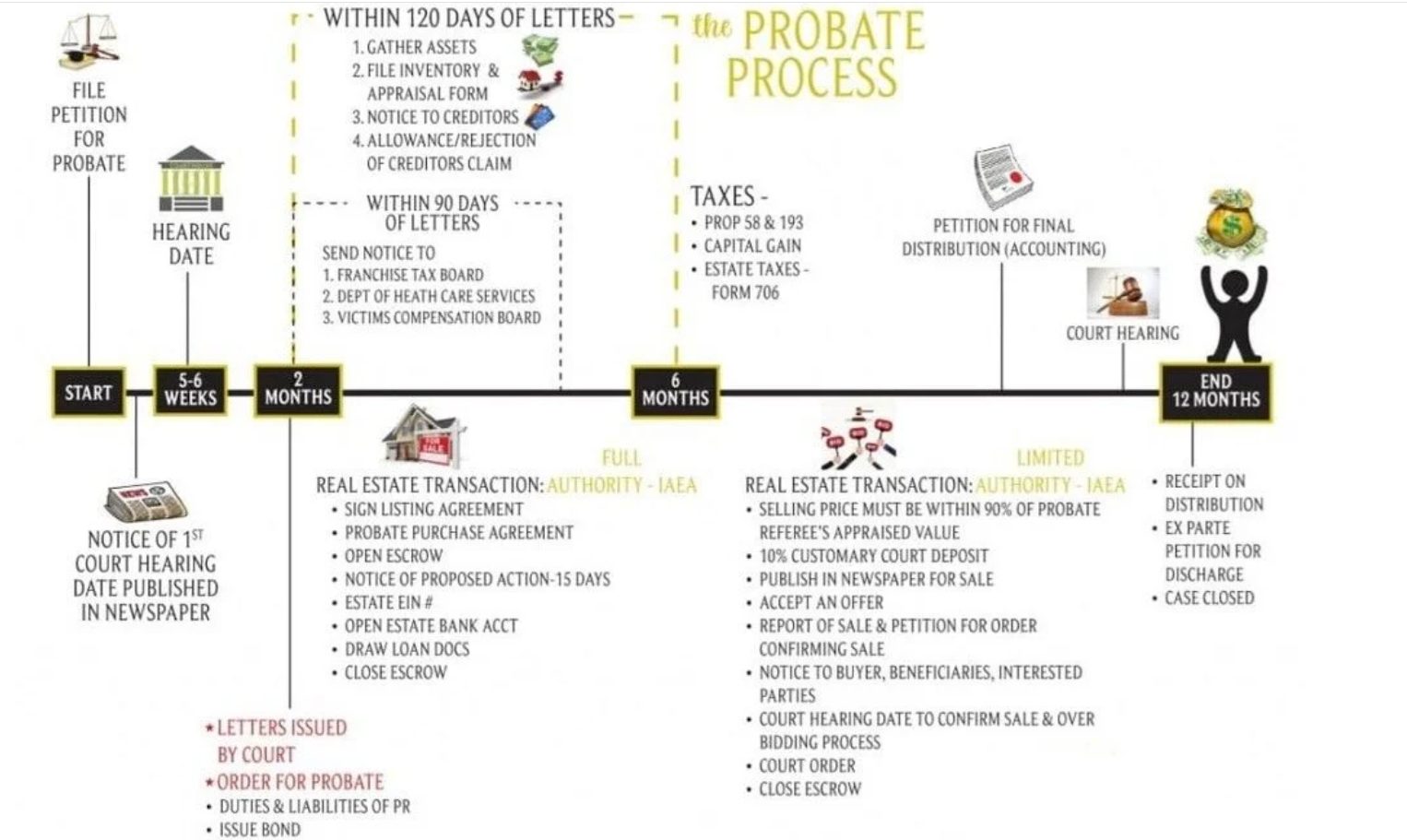

As a general rule, the entire process takes about 12 months to complete. To make it easier to understand, we’ve broken it down into five clear phases.

Phase 1: Getting Started – Filing the Petition

First, the process begins with a formal request to the court to get everything started.

- File the Petition: The proposed executor files a “Petition for Probate” with the local courthouse.

- Schedule a Hearing: Next, the court sets a hearing date to officially appoint the Personal Representative (the Executor or Administrator).

- Provide Public Notice: Importantly, a “Notice of Hearing” must be published in a local newspaper. This informs potential creditors and other interested parties about the proceedings.

Phase 2: Gaining Authority – Letters and Duties

At the first court hearing, the executor is formally empowered to act on behalf of the estate.

- Receive Court Orders: The judge issues an “Order for Probate” and grants “Letters.” These “Letters” are your official legal documents proving your authority to manage the estate.

- Understand Your Responsibilities: As the Personal Representative, you now have a fiduciary duty to manage the estate responsibly. The court may also require you to obtain a “bond,” which acts as an insurance policy for the estate.

Phase 3: Managing the Estate – Key Tasks and Deadlines

This is the most active phase. Once you receive your “Letters,” strict deadlines take effect.

Within 90 Days

You must notify specific state agencies:

- The Franchise Tax Board

- The Department of Health Care Services

- The Victims Compensation Board

Within 120 Days

You must complete several critical steps:

- Gather Assets: First, identify and secure all of the deceased’s property.

- Inventory & Appraisal: Then, file a detailed list of all assets and their official values.

- Notify Creditors: Furthermore, you must inform known creditors and publish a notice for unknown ones to come forward.

- Review Claims: Finally, you will evaluate and either approve or reject claims made against the estate.

Don’t Forget Taxes: You are also responsible for filing the final income, property, and potential federal estate taxes (using IRS Form 706).

Phase 4: Handling Real Estate Sales

Selling a house in probate requires following specific court rules.

- Get the Right Authority: Most estates use the Independent Administration of Estates Act (IAEA) for flexibility.

- List and Accept an Offer: You can work with a realtor to list the property and accept an offer, but the price must be within 90% of the court’s appraised value.

- Notify Interested Parties: You must file a “Notice of Proposed Action” to inform heirs of the planned sale.

- Get Court Confirmation: Often, you must get the sale approved at a court hearing, where others can place higher “overbids.”

- Close the Sale: After the judge approves the sale, you can close escrow and transfer the property.

Phase 5: Wrapping Up – Final Distribution and Closing

After all debts and taxes are paid, you can finish the process.

- File a Final Petition: You will submit a “Petition for Final Distribution” and a full accounting to the court for approval.

- Attend the Final Hearing: A judge will review your actions at a final hearing.

- Distribute the Assets: Once approved, you distribute the remaining assets to the beneficiaries.

- Close the Estate: Finally, beneficiaries sign receipts, and you file to be discharged from your duties, officially closing the case.